AstroSpringville - Moon Phases 2024

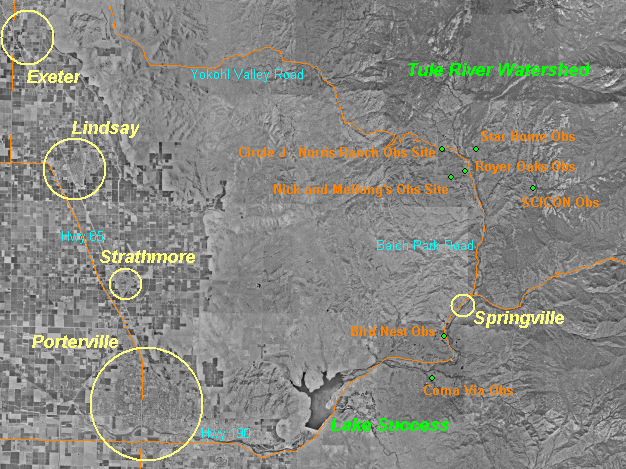

An astronomy haven in California’s Southern Sierra Foothills,

home of seven observatories and the Tule River Amateur Astronomers

- Bird’s Nest Observatory

- Coma Via Observatory

- Royer Oaks Observatory

- SCICON Observatory

- Starhome Observatory

- Tule River Amateur Astronomers

- Outdoor Lighting

- Astronomy Resources

- A Night on the Palomar 60"

- Eclipse 2005

- Let’s Look!

Bird Nest Observatory

Bird-nest Observatory, sits behind David and Dianna Bird’s house on the edge of Springville.

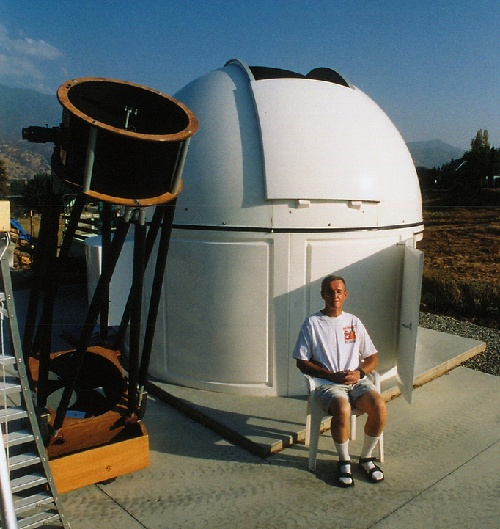

David Bird with his new observatory and 20" Obsession. The white fiberglass

observatory, prefabricated in Australia, is 11.5 feet in diameter and 10.5 ft. high.

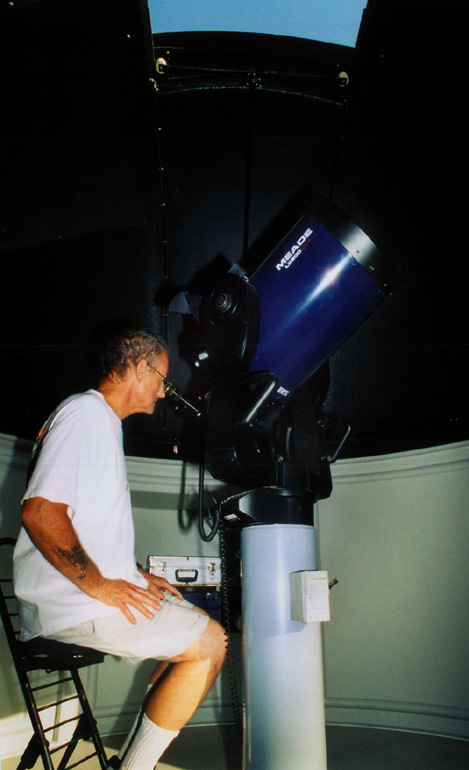

The observatory houses a 12 inch Meade Schmidt-cassegrainian telescope. The

alt-az mounted telescope has a huge built-in database and features go-to capability.

The observatory has a power rotation motor, which along with the heat vent at the top of the dome, is solar powered. There are 2 bump-outs handy for storing maps, charts, and accessories such as eyepieces.

Bird-nest Observatory is located at 34676 La Paloma Drive in Springville, California, just below the Rodeo Grounds off Rt. 190. It is equipped with two telescopes. A transportable 20" Dobsonian Obsession is used for star parties and observing away from home. The 12-inch Meade LX-200GPS is located within the 11.5 foot diameter white fiberglass dome made by Sirius Observatories in Australia.

Coma Via Observatory

…and all around

[360° VR Pan from Coma Via Observatory – Quicktime Required]

[360° VR Pan of our Back Yard – Quicktime Required]

[360° VR Pan of our Back Pasture – Quicktime Required]

[Vertical Panorama of one of our Local Sequoias]

Some views from the property

The dome houses a 12.5" f6 Newtonian on a Byers 812 mount. The adjacent deck has a central pier with an independent foundation to support an 18" Starsplitter which I have been using for monitoring variable stars in the mag-14 range. An extended part of the observatory is a 25" Dobsonian built from an Astro Systems Telekit housed on its own pad at Msgr. Ronald Royer’s “Royer Oaks” Observatory. The 25" is currently the focal point of community interest for public star parties.

Royer Oaks Observatory

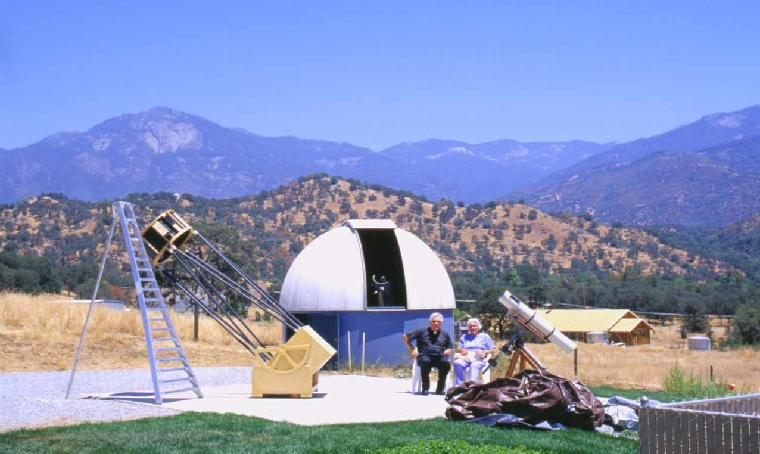

Royer Oaks Observatory, Springville, California is located just below John Sanford’s Starhome Observatory on Balch Park Road. (Starhome is visible as a white speck on the ridge just above the top corner of the 25" telelscope in this picture). When Monsignor Ronald E. Royer and his mother, Violet, moved to Springville they built a custom home and swimming pool and moved the observatory from its former location in Lakewood, CA where he was pastor of the St. Pancratius parish.

Msgr. Royer is a Roman Catholic priest, and a life-long amateur astronomer. He is active with AAVSO and his astrophotos are available from Science Photo Library. He chose to retire to Springville in 2002 because of the combination of dark skies and easy access to the necessities of senior living. The beautiful views of the Sierras with their rainbows, golden sunsets, and the Giant Sequoias on the ridge line (all easily visible from the house and observatory) are a bonus! E/MAIL

First Light (June 10, 2003) for the Chandlers’ new 25" Dobsonian (“Big Mama”) on its pad at Royer Oaks Observatory. Shown are Billie Chandler, Msgr. Royer, and 92 year-old “Mama” Royer seated in the background.

Alternative Observing Opportunity

SCICON Observatory & Circle J-Norris Ranch

SCICON (The Clemmie Gill School of Science and Conservation) is an outdoor education facility operated by the Tulare County Office of Education above Springville. We recognize that to understand the earth one must recognize the earth’s cosmic envrionment. To bring this understanding to our students in an experiential way we operate an observatory with a 14" Meade “go-to” telescope (housed in a roll-off observatory building), and a planetarium.

In addition to the observatory on the main SCICON campus, we have a number of 10" Dobsonian telescopes for use at the Circle J-Norris Ranch facility where students can learn to find things in the sky by themselves. The Circle J-Norris Ranch program includes workshops for teachers and opportunities for teachers to bring their classes at different times of the year outside the normal SCICON program.

Starhome Observatory

Starhome Observatory is a private facility built by and operated by John Sanford and located in Milo, 7 miles north of Springville, California. Milo doesn’t exist any more as a settlement, but is found on many maps as it was a lumber town in the early 1900’s and had a post office. The observatory is a two story building with a partial sliding roof, and houses two telescopes, a C-14 on Titan (Losmandy) mount, and an Astrophysics 6" f/9 refractor. The observatory is located on a small ridge affording good seeing most of the time. The altitude is approximately 2230’ (699m) above sea level. Climate is good, with clear nights from May through November and about 1/3 of the time in winter months.

Starhome is the small white building on the ridge shown above. The mountain is 9300’ Moses Mountain of the Sierra Nevada range in California.

Starhome is dedicated to two primary purposes. A public education function is served by visits from college and high school classes, and other groups, and the public on regularly held star party evenings. The other main purpose is to produce astronomical imagery for use in a stock photography business and for research into variable stars and supernovae. Reports are made regularly to the AAVSO and Association of Lunar and Planetary Observers.

A C-14 (a 14 inch Celestron product), which normally operates with an f/3.3 or f/6.3 focal reducer, and is mounted on a Losmandy Titan go-to equatorial mounting. A 6 inch refractor is used for lunar and planetary work, and is on a Losmandy GM-100 mount. Both can be used with a Starlight Xpress SXV-H9 megapixel astronomical CCD camera and film cameras with a variety of lenses. A 16-inch f/5.85 newtonian/dobsonian reflector and a 6-inch Maksutov telescope are both used for remote star parties and observing away from Starhome.

Starhome is used to produce illustration-quality images for the media, through my local photo agency called Astrostock and internationally through Science Photo Library in London. Also occasionally video is produced such as for the 2003 Mars opposition and the Shuttle reentry video made on February 1st as the Columbia started to disintegrate. NASA used this footage to help analyze the failure and NBC News broadcast the clip worldwide on Dateline and other programs.

Outdoor Lighting in Springville

In Springville we have dark night skies with a rich Milky Way overhead, and are working hard to keep it that way. We have circulated information from the IDA to raised the consciousness of good and bad lighting with the local conservation-oriented groups, such as the Sequoia Riverlands Trust and the Friends of the Tule River, to recognize that dark skies should be on the list of natural environmental qualities to be preserved. (S K Landscaping keeps Hubbell Sky Caps in stock locally to shield glaring mercury vapor lamps.)

While we’re on the subjec of lighting, compare these two views of identical mercury vapor lamps, one with and one without the Hubbell Sky Cap:

On the original site it was hard to tell from the nighttime picture that both lights were there! Local residents can see how effective shielding can be by noticing the lighting at El Nuevo Mexicali on Hwy 190. We donated the sky cap and Steve Koempel (of SK Landscaping) donated the labor to make it a model for the community.

Astronomy Resources

General Information

- APOD: Astronomy Picture of the Day / (APOD Archive)

- The Universe Today

- NASA Headlines

- Real-Time Day/Night Earth Map in Various Formats

- Heavens Above: Bird Nest, Coma Via, Royer Oaks, Starhome

- Terraserver: Bird Nest, Coma Via, Royer Oaks, Starhome

- “SkyView” Digital Sky Survey

- US Naval Observatory Data Services

- International Dark Sky Association

- Sky Online - Home Page

- Listing of Private Observatories

- Hubble Space Telescope Public Information

Deep Sky

- The Messier Catalog

- Deep Sky Image Archives

Comets & Asteroids

- Gary Kronk’s Comet &Meteor Home Page

- IAU/CBAT Comet Elements in Deep Space Format

Meteor Showers

- Gary Kronk’s Comet &Meteor Home Page

The Moon

- Moon Calendar

- Calendrier Nouvelle Lune et autres phases lunaires 2024

- Earth-Moon Viewer

- New Moon-Full Moon Dates

- Online Lunar Atlas

- Consolidated Lunar Atlas

- Lunation Animation

Eclipses

- Eclipse Home Page

- The Exploratorium Eclipse Site

- Solar Eclipse Eye Safety

- Observing Techniques

The Planets

- Planet Tracker

- The Solar System Live

- The Planet Finder

- Jupiter’s Moons

- The Nine Planets

- The Constellations

- Stories of the Constellations

- Hawaiian Astronomical Society

- Astronomy and Vedic Culture

A Night on the Palomar 60" Telescope

Jean Mueller invited some of us up to Palomar Mountain for a night on the 60" telescope

Jean is currently the night assistant on the 200 inch Hale Telescope. She is known mostly for her earlier work on the Second Palomar Sky Survey, done with the 48 inch Schmidt telescope. In conjunction with that project she scanned the plates and thereby discovered many asteroids, comets, and supernovas. She is standing here with a specially made “comet windmill”.

Let’s Look!

(A column by TRAA members in the Southern Sierra Messenger)

Constellation Orion the Hunter

With its bright stars Orion dominates the winter sky. This group of stars is mentioned in almost all ancient stories, and even in the Bible. His body is well outlined, but with a diminutive three-faint-star head, that is until red-sensitive astrophotography showed a big round faint nebulous head of glowing hydrogen gas. Most ancient stories depicted him as being very proud, big-head, which was his downfall. Our Milky Way galaxy is faint in this direction since we are looking away from our center, but this association of bright stars catches our attention. Apparently they were formed recently from the wealth of nebulosity in this area and so we have many bright, new stars there. Orion’s body is framed by these stars. Orange colored Betelgeuse is at the upper left, and blue Rigel at the bottom right. These are giant stars living fast as youngsters and will soon use up their atomic fuel as they form heavier elements such as make up our Earth. Betelgeuse is so large that if it were our sun we would be only one quarter of the way out to its surface. Close call! It may still harm us if it goes supernova, being only 600 light years distant. Three equally bright blue stars form his belt, and hanging from the belt are three fainter stars which form his sword. Imbedded in these stars is the Great Orion Nebula, remainder of the dust and gas cloud that formed, and is still forming, new stars in this area of the sky. This nebula is one of the most beautiful sights in a telescope, and photographs in wonderful color, red and green for the glowing gases, and blue for the dust particles reflecting the light of the nearby newly-formed blue stars. It lies nearby, relatively speaking, at about 1600 light years and takes light 30 years to cross it.

When I was young I heard a planetarium speaker say that its gases are so thin that all together they weigh as much as a steam locomotive. I guess those locomotives were very heavy then, about a billion times more than now! For indeed, we now know there is material there for hundreds of stars like our sun.

Comet Machholz in the evening sky

Last August Don Machholz of Colfax, CA, in the western foothills of the Sierra, discovered his 10th comet. It has now come closest to Earth, some 3 light minutes away, and appears as a fuzzy star to the naked eye up overhead. It is just now developing faint dust and gas tails. It is working its way up the Winter Milky Way toward the constellation of Perseus where it will pass the Double Star Cluster there January 27/28. Last week it passed the Pleiades star cluster, famous in all ancient cultures, in Japanese called Subaru. Machholz is hard to see with the naked eye, but a great sight in binoculars or scope. These Milky Way star clusters are very distant from the comet actually, 7000 and 450 light years respectably. For pictures of these objects, type APOD into your search engine. For maps to find the comet, type in COMET MACHHOLZ.

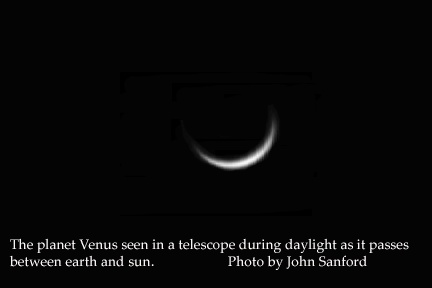

December Morning Sky Alive

Our morning sky still holds all the action with the planet Venus passing other planets. Back in early September she embraced old Saturn. Around November 4 she linked up with powerful Jupiter. Now in early December she is safely in the arms of weak and faint Mars. Always near the sun, Venus can never meet Mars when he is bright and warlike, which will happen this coming October and November.

After this encounter, she rushes to catch up with swift Mercury in the mornings after Christmas till the end of the year. This will be a good time to locate the elusive Mercury. Get out and look for these conjunctions about an hour before sunrise, around 5:45 A.M.

Such interesting conjunctions happened around the time of the first Christmas. The Magi knew the Hebrew Scriptures predicting a Messiah, so one of such may have started them on their journey. King Herod and his court never saw these morning or evening events since they were either partying or plotting evil. The Magi were the “early to bed, early to rise” wise guys!

Don’t forget to watch the Geminid meteor shower December 12-14, all night long.

The Zodiacal Light

The solar system is dusty, and we can see that dust in the sky. How, you might ask, can we tell where the dust in our atmosphere leaves off and the interplanetary dust begins? That’s a good question with a good answer.

Our solar system is flat like a disk because all the planets orbit the sun in approximately the same plane. So do the asteroids. When asteroid fragments collide they create dusty debris that litters the disk.

Looking at the solar system from earth is like looking at a pizza from the point of view of an olive. The planets and other material in the solar system are seen projected onto the sky as an encircling band passing through the Zodiac constellations, named for the “zoo” of mostly animal constellations that lie along it. The sunlight reflected from interplanetary dust particles appears as a faint glow along the zodiac, known as the “Zodiacal Light”.

To see the Zodiacal Light this time of year, go out shortly after it gets dark, around 7 p.m. or a little later. Look for a spike of faint glow extending from the western horizon almost straight up. (At other times of the year the spike tilts more to the south.) Compare the darkness of the sky along this band to the sky on either side. The Zodiacal Light is about as bright as the Milky Way, but smoother in texture. It is fatter toward the horizon and tapers down as you move farther from the sun. The glow seems like lingering twilight, but when you realize the twilight has disappeared everywhere else, you will have the evidence you need to identify it as the Zodiacal Light. If the fog blocks out Porterville’s light dome and you are above the fog, all the better. See how far into the sky you can follow it.

Don’t bother looking for the Zodiacal Light when you are down in L.A. or other cesspools of light pollution. Springville continues to be special in this regard, for now at least!

What’s In A Star Name?

As you read articles on astronomy such as this, you will notice–maybe to some degree of irritation–that there are terms we toss around as a matter of course. We need to explain some fundamental terms like for instance, how are stars named?

Constellations are nothing but groups of stars that have been determined to be a standard way to address certain parts of the sky. Those three bright stars in a row with distinctive bright stars above and below… we call that area Orion. There is an ancient linage of constellation names together with some more modern names that have been accepted as 88 internationally recognized standard constellations. In describing stars within a particular group ancient astronomers have handed down the practice of naming the brightest star in that pattern the Alpha star. It followed that the second brightest star in that group would be the Beta star, and so on. So when one hears a reference to Alpha Orionis, the star being named is the Alpha star of Orion. Some stars were involved in such widely acknowledged lore and legends that they were given names of their own- like Betelgeuse. But it will also be recognized as Alpha Orionis. As you can see the Greek star names and the Latin convention of grammar combine to make a system only a true astro-geek could appreciate. This system was good for a couple of thousand years.

As optics gave us more stars to ponder, we quickly ran out of letters in the Greek alphabet. Asronomers started to catalog stars and assign them numbers. What followed was a plethora of star naming systems like the Bayer, Flamsteed, Struve, and BD catalogs and their number systems. Today there are different naming systems depending on type of star. Variable stars have one system, supernovas are named differently. Some stars not already named are given a name which incorporates their address in the sky. But only authentic scientific institutions and researchers assign names recognized by the International Astronomical Union.

Now, you all are pros at the Name Game!

Saturn in the Eastern Sky

Just as Mars was at its closest to Earth in August, so too is the planet Saturn now closer to us than usual. Planets circle the Sun in non-circular orbits and now is our best view of Saturn, close to us, rings wide open, with its south pole toward us. Let’s look toward the East after dark and see the bright, golden colored planet in the constellation Gemini, The Twins. To the right is the bright constellation of the giant Orion, awakening on his side and leaping over our mountains toward us.

Saturn is an unreal sight in a telescope, yet it is the hallmark of celestial objects. People looking through my telescopes at it often remark, do you have a color slide ahead of the eyepiece? Its ring system is made up of millions of small satellites orbiting the planet, a unique sight, and just beyond the tips are the major satellites. You’ll never forget this sight! The delicate colors. The velvet black background.

The Winter Oval

The winter sky tonight offers the most bright stars in one view at one time. Look at a good star map or planisphere, and you can see all the bright stars marked in their constellations. The brightest star in the evening now is Sirius, which stands in first place among the nighttime stars. It’s in the south east as darkness falls and crosses the southern sky during the evening. Sirius is a blue-white star and only 8.4 light years away, right in the neighborhood as star distances go.

The winter stars form an oval, with Saturn, the ringed giant planet, inside the oval shape. This Winter Oval is formed by the stars (starting overhead with yellow Capella and moving counterclockwise): Castor and Pollux in Gemini, Procyon in Canis Minor, then bright Sirius in the south. Proceeding up the west side of the oval, we come to brilliant Orion, the Hunter, with its stars Rigel, a blue white giant, and then the three belt stars in line, and we finish the oval with the red gem Aldebaran, the eye of the Bull, in Taurus. Within the oval’s shape is Betegeuze in Orion, and Saturn, in Gemini, which you can tell by its tan color and the fact that because it’s a planet and has some size, it doesn’t twinkle like the stars do. The stars twinkle because they are so small that the bundle of rayscoming from each star and entering our eyes can be displaced momentarily by the earth’s atmospheric movements. A planet on the other hand is usually large enough that some of its light always reaches the eye, and therefore it shines more constantly.

There is one other planet to see in the early evening, and that is brilliant Venus, slowly rising higher at the same time each evening in the southwest right after dark.

So get outside and see the best show the night sky has to offer on these clear moonless evenings. And dress warm!